Manchester United shares flat after cut-price IPO

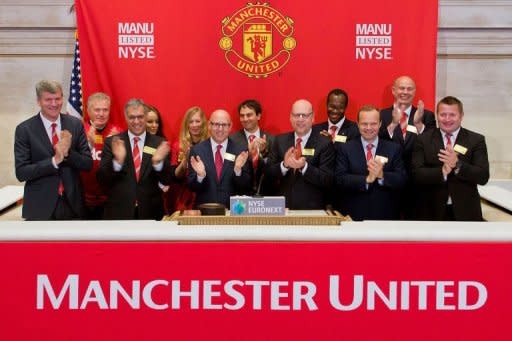

Manchester United shares barely treaded water in debut trade in New York Friday even after underwriters slashed the IPO price amid doubts about the legendary British football club's financial promise. Midway through trade the team's shares were changing hands at $14.00, the price set on Thursday for subscribers to the club's $234 million initial public offering. Analysts said underwriters were propping up the shares on the New York Stock Exchange to keep them from dropping below the issue price. Underwriters had already cut the offering from the expected $16-20 range, significantly reducing the $300 million sum the debt-ridden club had originally hoped to bring in. The launch ran into doubts from investors and analysts over whether Manchester United could match its fabulous record on the football pitch with a similar profit for share buyers. Investors have also become wary about aggressively priced IPOs since the much-promoted Facebook launch soured, with the social networking giant's shares slumping by nearly half since its May 18 listing. Manchester United has been mired in debt since 2005 after a heavily leveraged takeover by the Miami-based Glazer family, whose management since has endured heavy criticism from the team's tens of millions of fans. The IPO was originally planned for Hong Kong or Singapore, where the team apparently hoped the presence of millions of Asian supporters would help it raise enough to retire the current debt load of 423 million pounds ($660 million). But regulators in the Asian financial hubs reportedly looked askance at the company's two-tier share structure, with a small number of "A" shares to be sold to the public while the Glazers retained full control of the much larger number of "B" shares, each of which has 10 times the voting rights of "A" shares. That structure was not a problem with US regulators, but led to doubts from investment analysts. In addition, only half of the receipts from the 16.7 million shares offered in the IPO were to go toward debt reduction, while the other half would go straight to the owners, who put up 8.33 million of their share into the offer. "The question to ask is whether Manchester United is really the next Facebook Inc. IPO," said analyst Jon Ogg of 24/7 Wall St. "It has 600 million fans, it is under tight control by the Glazer family and it is full of hype," he said. "Perhaps the discounted price will keep some interest in the shares, but this dual class listing in New York is not allowed in London, where Manchester United should be based for its home market trading. "Man-U would easily fit on our list of companies where shareholders have no power -- at all," Ogg added. But Manchester United chief executive David Gill, told CNBC television he was optimistic about the club's future, with big opportunities to earn income through marketing partnerships with other firms. "We have a sensible business plan going forward. What we are doing today is for the long term plan of the club," he said. "What we can show... is we are very much a growth story, and in the current climate we all face, it's a very positive thing and people have bought into it," he said. Gill said the management is "very comfortable" with its debt level, "particularly given the growth of opportunities," for the club.